Proactive loans for businesses who qualify.

The client

An Australian multi-national bank, focused on providing financial services and products for business.

Our task

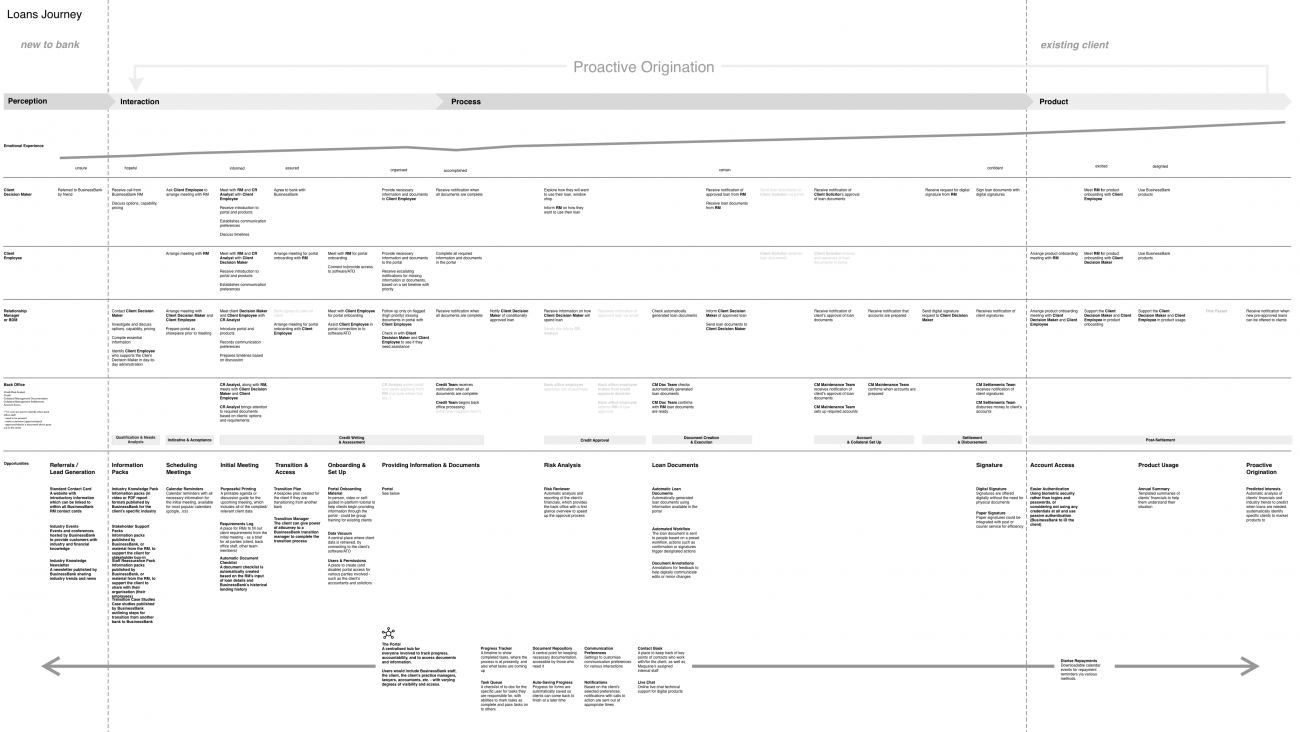

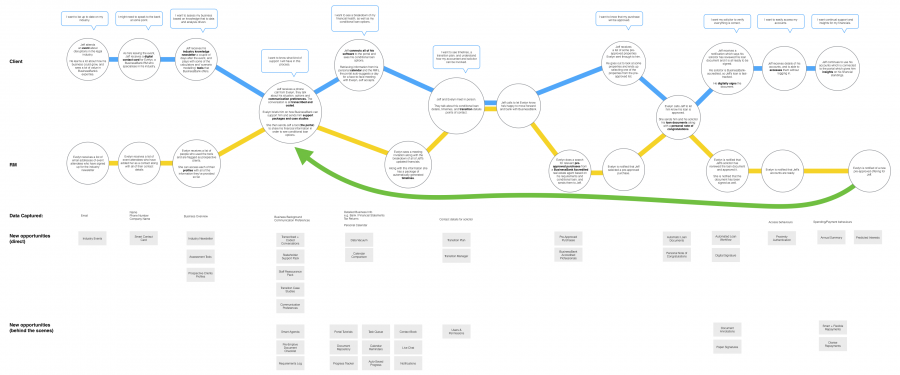

To document the loan journey for both customers and the bank’s back office. Then to ideate how the bank can be proactive throughout the origination process.

The team

- 2 senior UX consultants

- senior manager from the bank

Co-creation workshops

Planning

Following methods from the Convivial Toolbox (Sanders & Stappers – great for generative workshops), we prepared activities for participants to reflect, enact, and ideate on their experiences.

Facilitating

We took turns facilitating multiple co-design workshops. This allowed for each of us to be observers as well as facilitators.

Presenting insights

Our team presented workshop artefacts and insights back to key stakeholders and product managers.

Outcome

The simplified journey map was printed and presented to digital teams within the bank. The different teams were able to take away relevant opportunities from our research and workshops. The detailed service blueprint was shared amongst senior managers for addressing operational improvements.

Overall this was a successful discovery project.

Vector images by pikisuperstar.